2024 Tax Depreciation Rules. First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). The start of a new financial year.

Tax legislation, with 100% bonus depreciation standing out as a. The “tax relief for american families and workers act of 2024” heralds a new chapter in u.s.

6 Min Read 02 May 2024, 12:49 Pm Ist.

Property placed in service in 2024 will only benefit from a 60% bonus depreciation rate, with the rate further diminishing in future years.

As A Business Owner, Depreciation Is An Important Factor In Your Accounting Process And.

Prior to enactment of the tcja, the additional.

This Means Businesses Will Be Able To Write Off 60% Of.

Images References :

Source: hoodcpas.com

Source: hoodcpas.com

Understanding Tax Depreciation Rules for 2023 and 2024 Bonus, In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn't. The bonus depreciation deduction under section 168 (k) begins its phaseout in 2023 with a reduction of the applicable limit from 100% to 80%.

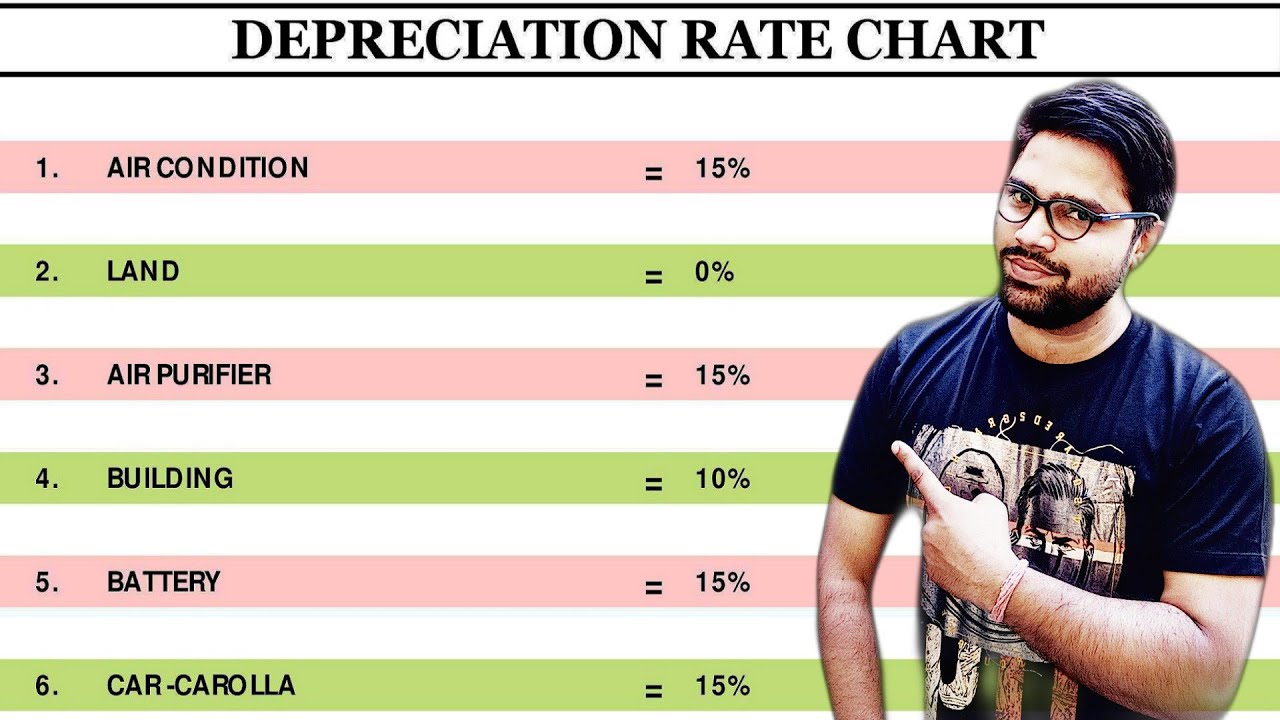

Source: www.youtube.com

Source: www.youtube.com

How To Calculate Depreciation Chart as per Tax Rules How To, For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024, you can elect to take a special. First, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k).

Source: www.youtube.com

Source: www.youtube.com

Depreciation Rate As per Tax Rules Depreciation Rate Chart, This comprehensive guide explores the rising importance of cost segregation, a strategic financial tool for property owners and investors. Bonus depreciation works by first purchasing qualified business.

Source: bceweb.org

Source: bceweb.org

Depreciation Rate Chart A Visual Reference of Charts Chart Master, For certain qualified property acquired after september 27, 2017, and placed in service after december 31, 2022, and before january 1, 2024, you can elect to take a special. Learn how cost segregation can.

Source: www.youtube.com

Source: www.youtube.com

Dep Rate Chart Depreciation Depreciation Rate As Per Tax, 6 min read 02 may 2024, 12:49 pm ist. This means businesses will be able to write off 60% of.

Source: investguiding.com

Source: investguiding.com

Rental Property Depreciation How It Works, How to Calculate & More (2024), The bonus depreciation deduction under section 168 (k) begins its phaseout in 2023 with a reduction of the applicable limit from 100% to 80%. One of the allowable deductions under the income tax act is.

Source: haipernews.com

Source: haipernews.com

How To Calculate Notional Depreciation Haiper, Utilize both bonus depreciation and section 179. What you need to know about depreciation in 2024.

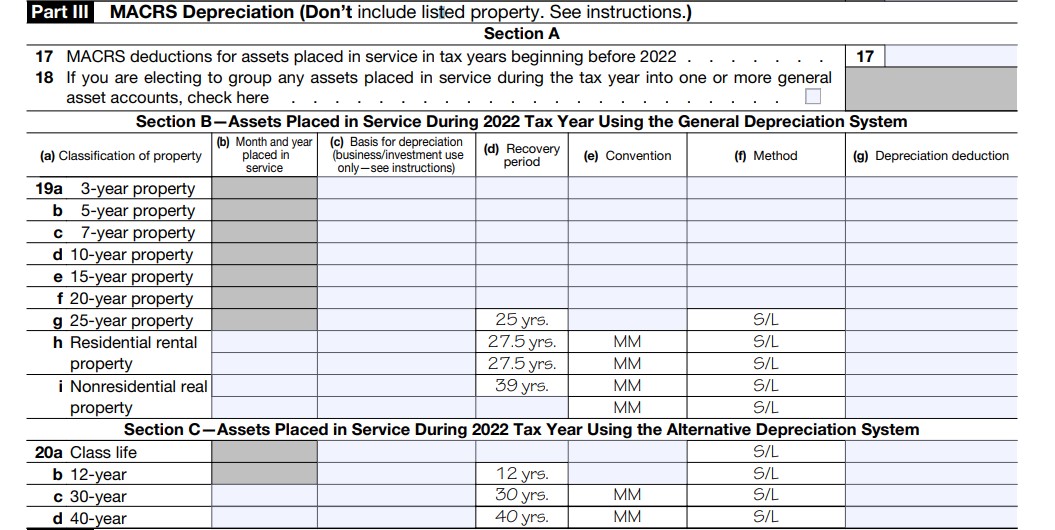

Source: nlgroup.com

Source: nlgroup.com

Depreciation Table for Common Business Assets Naden/Lean LLC, All macrs depreciation tables reproduced in full text; This means businesses will be able to write off 60% of.

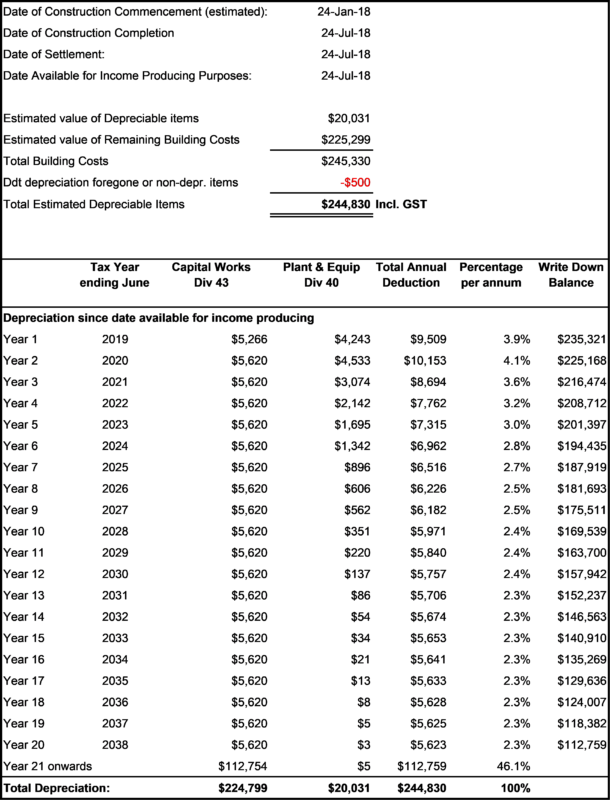

Source: budgettaxdep.com.au

Source: budgettaxdep.com.au

How much depreciation can i claim Budget Tax Depreciation, Prior to enactment of the tcja, the additional. How is bonus depreciation set to change in 2024?

Source: www.youtube.com

Source: www.youtube.com

IRS Rental Property Depreciation Rules 2024 How Does Rental Property, Specifically, the bill proposes temporary reinstatement of certain business tax benefits that were part of the tax cuts and jobs act, including: This comprehensive guide explores the rising importance of cost segregation, a strategic financial tool for property owners and investors.

Depreciation Can Open Doors To Tax Deductions That Reduce Tax Bills By A Significant.

In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn't.

The Start Of A New Financial Year.

As a business owner, depreciation is an important factor in your accounting process and.