What Is The Due Date To Pay Taxes 2024. The final quarterly payment is due january 2025. Filing deadline for 2023 taxes.

First estimated tax payment for tax year 2024 due. The fourth month after your fiscal year ends, day 15.

Filing Deadline For 2023 Taxes.

Personal income tax due dates.

If Day 15 Falls On A Saturday, Sunday Or Legal Holiday, The Due Date Is.

File 2023 tax return and.

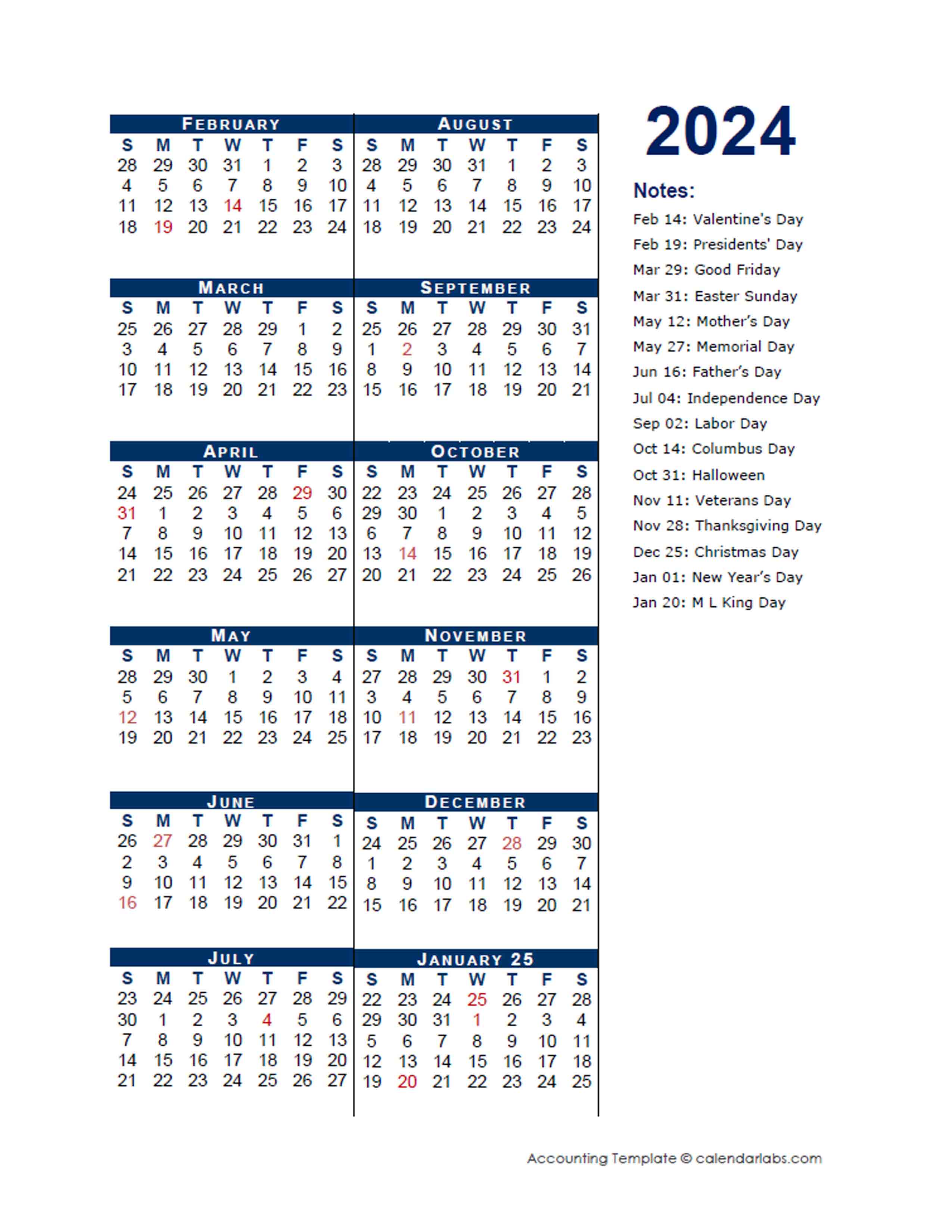

In 2024, Estimated Tax Payments Are Due April 15, June 17, And September 16.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Apply online for a payment plan. The estimated federal tax deadlines for 2023 are april 15, 2024;

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Tax Refund Calendar 2024 Calendar Printable, Find key dates for filing and paying taxes, and for receiving credit and benefit payments from the cra. The final quarterly payment is due january 2025.

/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg) Source: www.thebalance.com

Source: www.thebalance.com

Federal Tax Deadlines in 2022, Personal income tax due dates. The final quarterly payment is due january 2025.

Source: www.vrogue.co

Source: www.vrogue.co

Federal Pay Period Calendar 2024 Pictures Of A Map Of vrogue.co, First estimated tax payment for tax year 2024 due. Tips for march 2024 reported to employer:

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Tips for march 2024 reported to employer: First estimated tax payment for tax year 2024 due.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, If day 15 falls on a saturday, sunday or legal holiday, the due date is. Earned income tax credit awareness day.

Source: www.consultease.com

Source: www.consultease.com

Revised Dates of Various Compliances or Payments under Tax Act, Earned income tax credit awareness day. Fiscal quarter and due date table;

Source: dtaxc.blogspot.com

Source: dtaxc.blogspot.com

Payroll Tax Liabilities Due Date DTAXC, In 2024, estimated tax payments are due april 15, june 17, and september 16. Earned income tax credit awareness day.

Source: marylindawhynda.pages.dev

Source: marylindawhynda.pages.dev

2024 Tax Payment Dates Perle Brandice, Fiscal quarter and due date table; If day 15 falls on a saturday, sunday or legal holiday, the due date is.

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, In that case, you don't have to make an estimated tax payment until sept. Avoid a penalty by filing and paying your tax by the due date, even if you can’t pay what you owe.

21, 2024 — During The Busiest Time Of The Tax Filing Season, The Internal Revenue Service Kicked Off Its 2024 Tax Time Guide Series To Help Remind Taxpayers Of.

Estimated tax payments on income earned during the third quarter of the year (june 1, 2024, through aug.

First Required Minimum Distribution (Rmd) By Individuals Who Turned 73 In 2023:

1 if you need to pay estimated.